Wander was built with the goal of delivering the ultimate vacation rental guest experience and helping as many people as possible “Find Their Happy Place™”. Wander Atlas REIT, Inc. (“Wander REIT”) provides a vehicle for our members, guests and existing investors to invest in Wander’s high-end network of homes.

Wander REIT is the first vacation rental REIT, and its edge lies in its close affiliation with Wander. Because Wander controls every aspect of the customer journey — from the home, to the booking platform and the total guest experience — we're well-positioned to drive higher occupancy and higher customer satisfaction, which ultimately has the potential to translate into higher returns for Wander REIT investors.

Wander REIT gives investors the opportunity to invest in vacation rentals without the hassle of individual vacation home ownership. It targets annual income of 7-8% and a total annualized return including appreciation of 14%. Investors not only get the benefit of potential returns, but also tax-advantaged income, so they can keep more of what they earn. Investors also benefit from portfolio diversification and access to exclusive perks that allow them to enjoy the underlying product: the Wander homes.

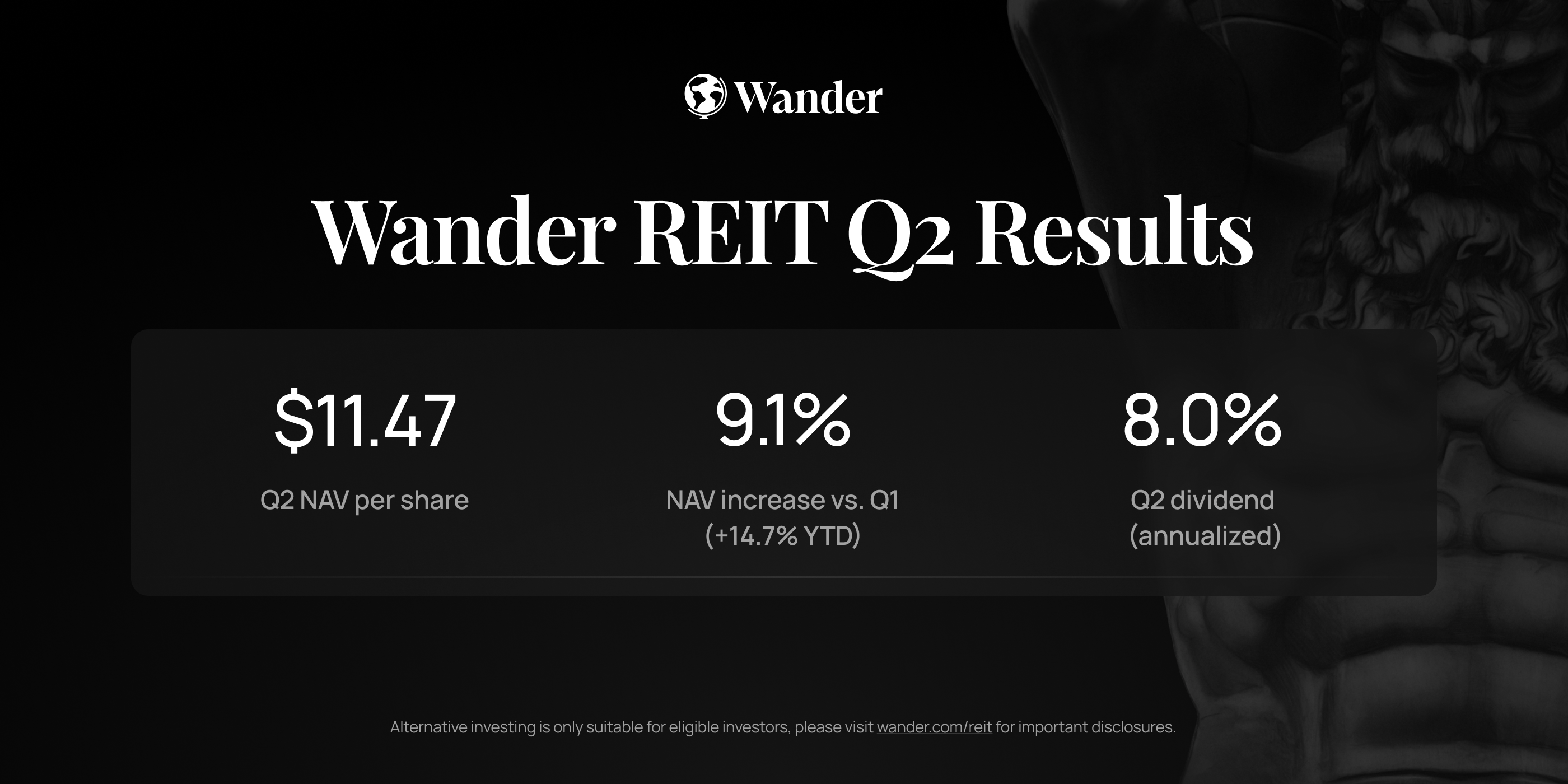

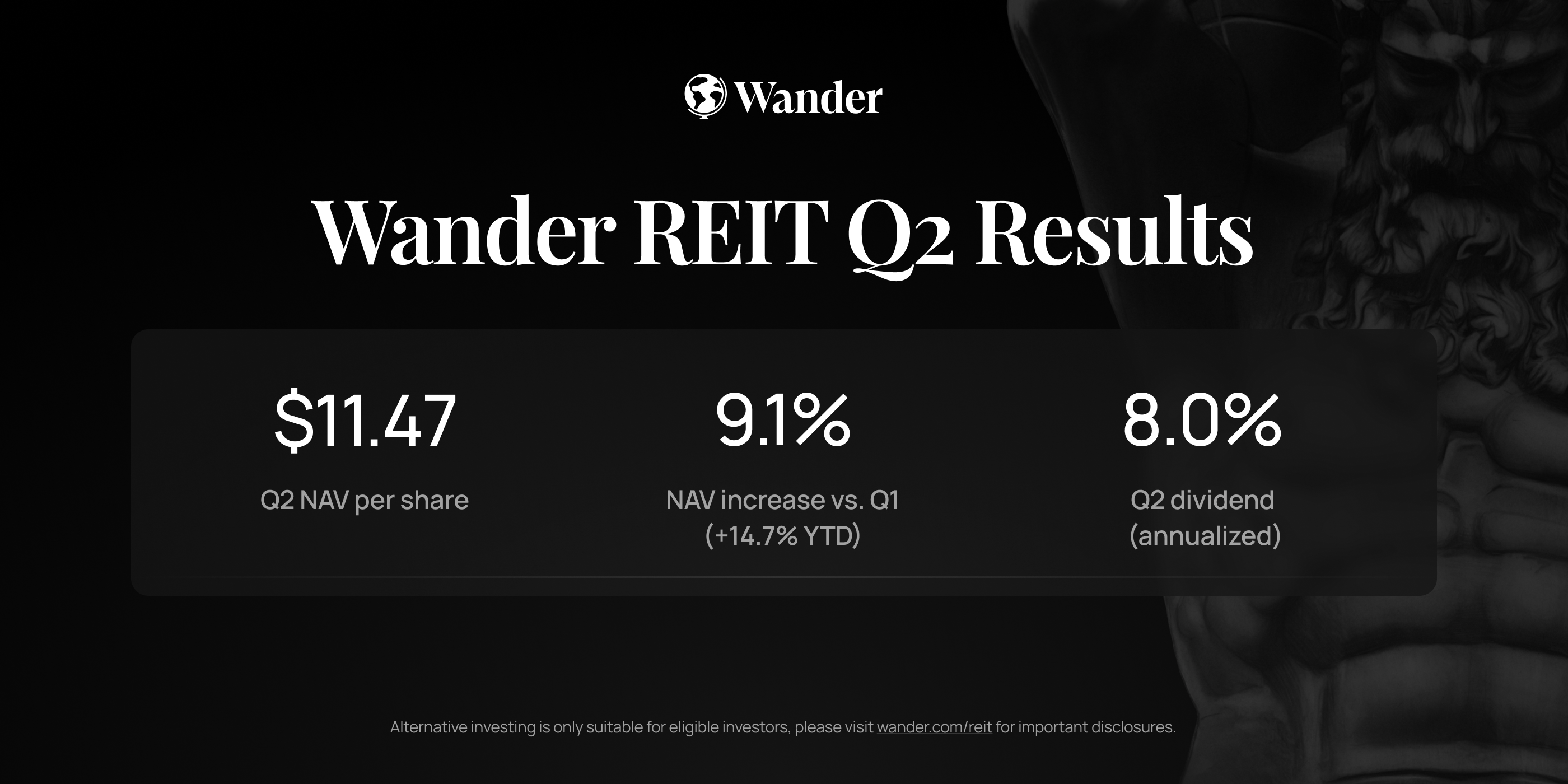

Q2 Results

Each quarter, our investors receive an update from our leadership team in which we share portfolio and Wander REIT performance information. We wanted to make this information available to prospective investors so you can get a better understanding of our REIT offering and its performance. With that being said, we are excited to share a few highlights from our second quarter activity!

We are pleased to announce the addition of our sixth portfolio property, Wander Anchor Cove! Wander Anchor Cove is located in Gualala, California, approximately 120 miles north of San Francisco, next door to another Wander REIT property, Wander Anchor Bay. The proximity of the two properties affords us the unique opportunity to market both homes together as “Wander California Coast”, a spectacular offering including six bedrooms of luxury accommodation spread across ten acres of pristine California coastline!

This quarter we are pleased to distribute our second quarterly dividend of $0.21 per share, which similar to last quarter, equates to an 8.0% annualized return. Additionally, following updated property appraisals, the portfolio benefited from a 9.1% increase in net asset value (NAV) over Q1 2023 (14.7% increase YTD).

Thank you to current and future investors for your continued trust in the Wander team and your support of Wander REIT.

Legal disclosures and risk factors-please read

An investment in our common stock involves a high degree of risk. Before making an investment decision, you should carefully consider the risks described in “risk factors” beginning on page 37 of the PPM before investing in our common stock. If any of the risks discussed in the PPM occur, our business, prospects, financial condition, results of operations and ability to make cash distributions to our stockholders could be materially and adversely affected. In that case, the value of our common stock could decline significantly, and you could lose all or a part of your investment. Some statements in the PPM, the risk factors in the PPM and statements in this update constitute forward-looking statements. See “cautionary note regarding forward-looking statements” in the PPM. There is no current public market for our common stock. The shares of our common stock offered hereby have not been registered under the securities act or the securities laws of any other jurisdiction. Until such shares have been registered, they may be transferred only in transactions that (a) are exempt from registration under the securities act and the applicable securities laws of any other jurisdiction and (b) bind such transferees to the terms and conditions upon which such transferring stockholder is bound. See “summary of material agreements, our stock and our corporate governance - restrictions on ownership and transfer.” Hedging transactions involving our common stock may not be conducted.

This update is intended solely to provide investors with an overview of how Wander.com, inc. (“Wander”), the sponsor of Wander Atlas REIT, inc. (“Wander REIT”) approaches the short-term rental business. It is not intended as a supplement to the PPM and no investor should rely on this update in making their investment decision in connection with Wander REIT. For the avoidance of any doubt, the PPM is the sole controlling document for all information concerning investment in Wander REIT. Investors are referred to the PPM for a description of the relationship between Wander and its affiliates and Wander REIT, and the related risks associated with an investment in Wander REIT. Neither Wander nor Wander REIT can guarantee future performance or any return on investment. Like any investment, an investment in Wander REIT entails the risk of loss of some or all of one’s invested capital. The PPM explains in detail the risks associated with an investment in Wander REIT and the related terms and conditions of the investment and it should be read carefully and in detail before investing. The PPM is the sole and exclusive source of information concerning investment in Wander REIT.

You should rely only on the information contained in the offering memorandum/ppm. None of us, or any of our subsidiaries or affiliates (or wander.com and its subsidiaries and affiliates) have authorized anyone (including employees of Wander and its subsidiaries and affiliates), to provide you with information different from that contained in the offering memorandum. We do not take responsibility for, nor can we provide any assurance as to the reliability of any information that anyone may give you that is not otherwise contained in the offering memorandum.